Table of Contents

Cryptocurrency has become a hot topic in the world of finance. More people are diversifying their portfolios—in addition to investing and stocks and real estate, they're also investing in crypto. Its popularity has led to many questions, such as "do I have to pay taxes on cryptocurrency?" With the growing number of people investing in crypto, it's essential to understand the tax implications of these investments.

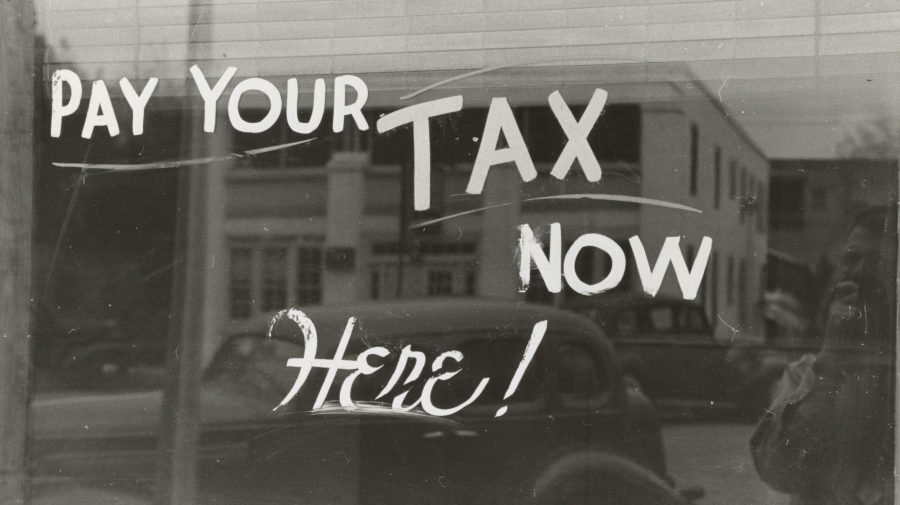

Tax season is right around the corner! So, let's discuss how to report cryptocurrency on taxes for trades and investments, how to do it the right way, and the difference between long-term and short-term capital gains.

What Is Cryptocurrency?

Before diving into the tax implications of cryptocurrency, let's first understand what cryptocurrency is. Cryptocurrency is a digital currency that operates independently of a central bank. People can trade it, invest in it, and even use it to buy goods and services.

The most well-known cryptocurrency is Bitcoin. Besides Bitcoin, there are other common ones like Ethereum and Litecoin. You can buy and sell crypto on exchanges like Coinbase, and their value fluctuates based on market demand.

Do I Have to Pay Taxes on Cryptocurrency?

In short, yes—you have to report cryptocurrency on your taxes. The IRS has clarified that crypto is "property" for tax purposes. Any gains and losses from the sale or exchange of crypto must be reported on your tax return every year.

What does this mean exactly?

If you buy crypto and sell it for a profit, you must report that profit on your tax return. Conversely, if you sell crypto for a loss, you can use that loss to offset any gains on your tax return.

Remember: It's the taxpayer's responsibility to report their losses and gains. Even if you don't receive a 1099 form from your exchange(s), you still need to report crypto losses and gains.

Steps on How to Report Cryptocurrency on Taxes

Paying taxes on cryptocurrency can be complicated, especially if you've never done it before. But there are a few steps you can take to make the process of how to report cryptocurrency on taxes easier:

1. Keep Accurate Records

The first step to properly reporting crypto gains and losses is to keep accurate records of all your crypto transactions. This includes the date you bought or sold the asset(s), the amount you bought or sold, and the price at which you bought or sold it. It may help to keep track of everything on a spreadsheet if you use multiple exchanges.

2. Determine Your Basis

Besides keeping an accurate record of your crypto transactions, you need to figure out your basis in the cryptocurrency. This is the amount you paid for the crypto, including any fees you paid when buying or selling it.

3. Calculate Your Gains and Losses

After determining your basis, it's time to calculate your gains and losses. To do this, subtract your basis from the amount you received from selling or exchanging the crypto.

4. Report Gains and Losses on Your Tax Return

Report your calculated gains and losses in Section D of your tax return. This section is specifically for reporting capital gains and losses.

Long-Term vs. Short-Term Capital Gains: What's the Difference?

It's worth noting that crypto transactions can trigger capital gains tax. This is a tax on the profit you make from selling an asset. Capital gains rates vary depending on how long you've held onto the asset before selling it.

If you hold a cryptocurrency for less than a year, the gain is "short-term," so you'll get taxed at the ordinary income tax rate. But if you hold it for more than a year, it's "long-term," and you'll get a nice tax break.

Report Crypto Gains and Losses to Prevent Audits

While cryptocurrency is still evolving, the IRS makes it clear that taxpayers must know how to report cryptocurrency on taxes. Ensure you're properly reporting your gains and losses by keeping accurate records, determining your basis, calculating your gains and losses, and reporting them on Schedule D of your tax return.

It may help to hire a professional to help you maneuver filing taxes on cryptocurrency if you've never done it before or aren't sure how to go about it. A qualified tax professional can address any questions or concerns you may have and keep you informed about the latest crypto tax implications. This can help you avoid potential penalties like getting audited.

Looking to learn more about all things cryptocurrency? Join AR Collective to access a wealth of resources and knowledge from seasoned traders. Members can ask any questions they have about trading and investing in crypto, intricacies around filing taxes, global finance news, and more. Other more experienced members will step in and share information on investing, trading, or even how to report cryptocurrency on taxes.* We look forward to having you!

*We aren't tax professionals. Always verify any information you get with a qualified accountant who specializes in filing taxes on cryptocurrency.