Next-gen crypto trading, research, and analysis

A Community Brimming with Knowledge

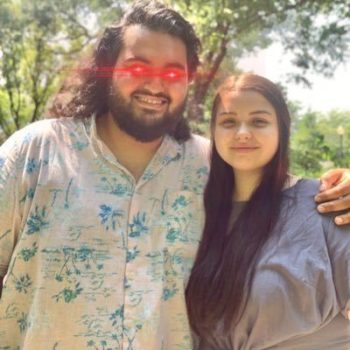

Long before ARCollective was formed, our co-founders, Athena and Reda worked tirelessly for months on Discord servers to equip others with the skills needed to become successful. Their trading styles were different but complementary to each other, and they built a friendship based on their mutual interests and desire to help others achieve their goals. These soon-to-be founders realized the next natural progression of their journey was to start their own group. And based on that, ARCollective was founded, so that Athena and Reda could pursue their passion for developing the next generation of cryptocurrency traders, analysts and researchers....

They are truly unique in this field because their goal is not fame, influence or to personally enrich themselves at the cost of others. They will not make excessive calls in an uncertain market, they will not fill you with false hope, and most importantly, they will never disappear on you no matter what bear or bull market comes. Instead, they grind around the clock to bring you high quality content that you will not find anywhere else. They consistently provide livestreams to their community which include a mix of their specialties - Technical Analysis to analyze price action, Fundamental Analysis to understand tokenomics, Venture Capital funding, and many other considerations not visible on the charts. Furthermore, ARCollective is brimming with helpful and knowledgeable members who are always willing to lend a hand to newcomers with questions.